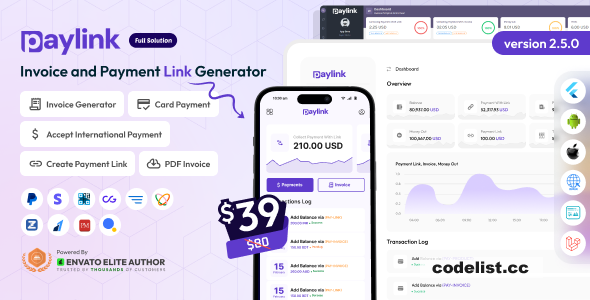

Introducing PayLink, the ultimate payment and invoicing solution meticulously crafted for entrepreneurs and startups. With PayLink, you’ll gain access to a comprehensive package that includes a highly responsive website, versatile cross-platform Android and iOS apps, and a user-friendly admin panel.

In the evolving world of payments and invoicing, small businesses, freelancers and startups constantly seek tools that let them generate invoices, create payment links, and manage transactions — without getting bogged down in complex legacy systems. That’s where PayLink comes in: a full-solution package offering invoicing + payment-link generation + multi-platform support. According to its listing, the software offers a website, apps, admin panel, PDF invoices, international payments, direct payment links, and more. CodeCanyon+1

Here are some of the major features of PayLink:

Ability to create invoices, presumably with PDF output. CodeCanyon+1

Generate payment links that can be sent to clients/customers, making payment easier and more direct. CodeCanyon

Multi-platform support: appears to include a website plus mobile apps (or at least the listing suggests “apps”). CodeCanyon+1

Admin panel for oversight, likely useful for managing clients, invoices, payment links, etc. CodeCanyon

Support for international payments — meaning, presumably, multiple currencies, or at least ability to deal with clients globally. CodeCanyon

For a lot of micro-businesses and freelancers, setting up a payment/invoicing system can be tedious: you may need separate tools for invoice creation, email, payment gateway integration, link generation, follow-up, etc. With PayLink, the promise is to bring many of those pieces together. Here’s why that matters:

Streamlined workflow: Instead of juggling multiple platforms, you can generate an invoice, send a link and receive payment all from one system.

Professional presentation: Having PDF invoices and clean payment links can boost credibility with clients.

Reduced friction for customers: A direct payment link is easier for the customer to click and pay — fewer steps means fewer drop-offs.

Scalability: If you have clients in multiple geographies, the “international payments” capability is a plus.

Control & oversight: The admin panel means you’re not flying blind — you can track what’s been sent, paid, pending, etc.

Here are some scenarios where PayLink might fit particularly well:

A consultant/freelancer who needs a simple system to invoice multiple clients each month and send them a payment link.

A small service business (e.g., graphic design, tutoring, small agency) that wants to offer clients a clean, modern payment option rather than relying on bank transfers or manual invoices.

A startup or side-business that occasionally deals with international clients and wants a unified system.

Anyone wanting to avoid building from scratch: if you don’t want to integrate multiple plugins and gateways manually, this kind of “full-solution” script can save time.

While the listing looks promising, as with any script/tool you’ll want to do your homework:

Payment gateway support: What gateways are supported (Stripe, PayPal, Razorpay, etc)? Are they easily configurable for your country (India, in your case)?

Currency & locale support: Since you're in India (Kolkata), check if it supports INR, Indian tax/invoice formatting, GST considerations, etc.

Security & compliance: Does it follow best practices around secure payments? Are there updates, bug fixes, etc?

Customization: Can you brand the invoices, links, emails? How flexible is the UI?

Mobile apps vs responsive web: The listing says “apps” — are they native mobile apps or just web-based? If you expect mobile usage, check performance and compatibility.

Support & documentation: What level of documentation, updates and support is provided by the author?

Cost vs benefit: While the tool may save you time, you’ll still need hosting, possibly gateway fees, etc. Make sure the overall cost of ownership makes sense.

In my view, PayLink looks like a strong contender for anyone wanting to simplify invoice + payment-link workflows without investing huge time building custom systems. It’s particularly appealing if you have multiple clients, recurring invoices, or global customers. From the listing, the fact that it bundles invoice creation, payment link generation and multi-platform support is a plus.

However: if your business is very simple (say, one client, one invoice a month, local currency only), you might not need the full breadth of features — you might be fine with simpler tools (Google Docs + payment link). So the key is: match the tool’s complexity to your actual needs.

Since you are based in Kolkata, India, I’d suggest verifying Indian-specific requirements: currency, tax (GST), invoice legalities, local gateway support, etc. If all that fits, this could be a great option.

Demo: https://codecanyon.net/item/paylink-invoice-and-payment-link-generator-full-solution/49356964